Managing payroll is a complex task that requires attention to detail, precision, and the ability to handle large amounts of data. Payroll managers are responsible for ensuring that employees are paid correctly and on time, complying with tax regulations, and handling various employee benefits. However, these tasks can be time-consuming and prone to errors.

ChatGPT, an AI-powered language model, can help payroll managers automate and streamline many aspects of payroll processing. By using the right prompts, payroll managers can use ChatGPT to generate reports, calculate payroll taxes, handle employee queries, and more.

In this blog post, we will explore various ChatGPT prompts specifically tailored for payroll managers, helping them optimize their workflow and reduce manual effort. We’ll also include tips, statistics, and relevant resources to ensure you get the most out of ChatGPT in payroll management.

Why Use ChatGPT for Payroll Management?

Payroll managers deal with numerous tasks, from calculating employee wages to ensuring compliance with tax laws. By using AI tools like ChatGPT, payroll managers can save time, reduce errors, and improve overall efficiency. Here’s why ChatGPT is a valuable tool for payroll managers:

- Automation: ChatGPT can help automate repetitive tasks like payroll calculations, tax filings, and report generation, allowing payroll managers to focus on higher-level decision-making.

- Error Reduction: By providing accurate data processing capabilities, ChatGPT reduces the likelihood of human error in payroll calculations, leading to better accuracy.

- Time Savings: Automating tasks with ChatGPT can significantly reduce the time spent on manual data entry, allowing payroll managers to meet deadlines more efficiently.

- Compliance: ChatGPT can assist in ensuring that payroll processes adhere to local and federal tax laws and regulations, minimizing compliance risks.

- Employee Support: ChatGPT can be used to quickly generate responses to employee payroll queries, improving communication and satisfaction.

Key Statistics on Payroll Automation

Here are some statistics that highlight the importance of automating payroll processes:

| Key Metrics | Data |

|---|---|

| Time saved on payroll processing | Businesses can save up to 80% of time by automating payroll processes [SHRM Report]. |

| Error reduction with payroll automation | Automated payroll systems reduce errors by approximately 35% [CIPD Study]. |

| Cost savings from payroll automation | Companies report saving around $5 per employee per pay cycle after automating payroll [Payroll.org Report]. |

These statistics show the clear benefits of leveraging automation tools like ChatGPT for payroll management.

ChatGPT Prompts for Payroll Calculation and Processing

One of the most important tasks for payroll managers is ensuring accurate and timely payroll processing. ChatGPT can assist by automating calculations for gross pay, deductions, overtime, and taxes. Below are some effective prompts for payroll processing:

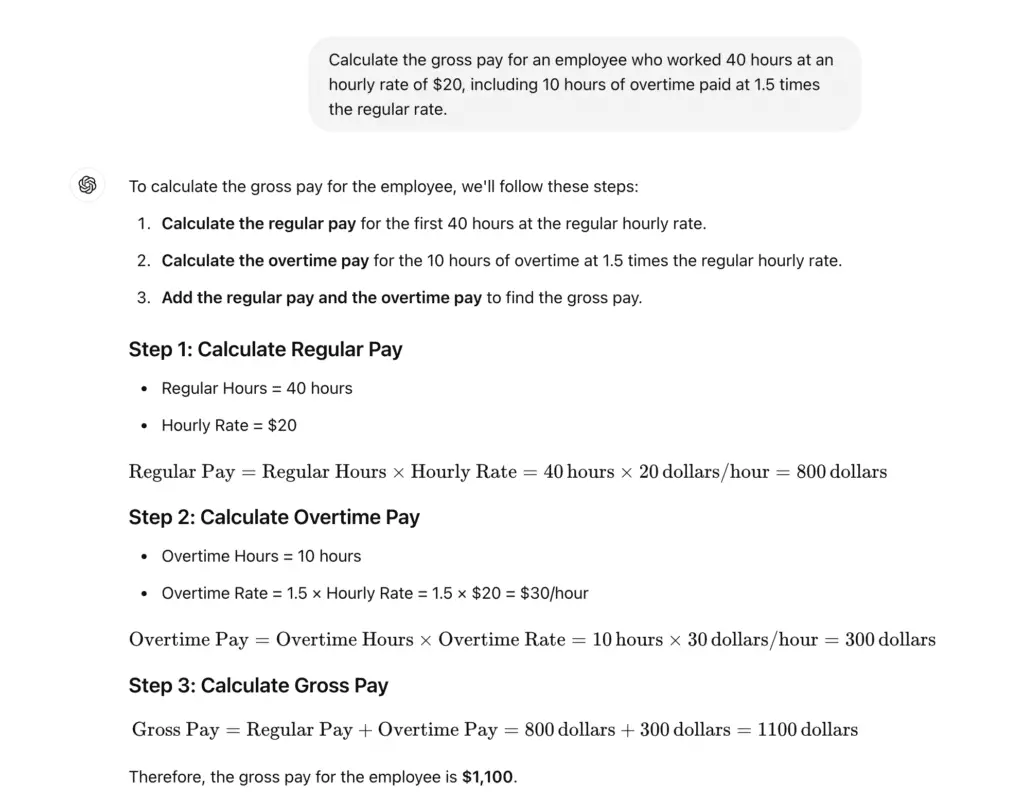

1. Gross Pay Calculation

Calculating gross pay involves considering the number of hours worked and the employee’s hourly rate. Use this prompt to simplify the process:

Prompt: “Calculate the gross pay for an employee who worked 40 hours at an hourly rate of $20, including 10 hours of overtime paid at 1.5 times the regular rate.”

ChatGPT will provide the exact calculation for gross pay, including overtime, saving time and minimizing errors.

2. Payroll Tax Calculation

Payroll managers must calculate and withhold various payroll taxes such as federal income tax, Social Security, Medicare, and state taxes. Here’s a prompt for calculating payroll taxes:

Prompt: “Calculate the federal income tax, Social Security, and Medicare withholdings for an employee earning $3,000 in a biweekly pay period. The employee is single and claims one allowance.”

ChatGPT will generate the necessary tax withholdings, ensuring compliance with IRS regulations and accurate deductions.

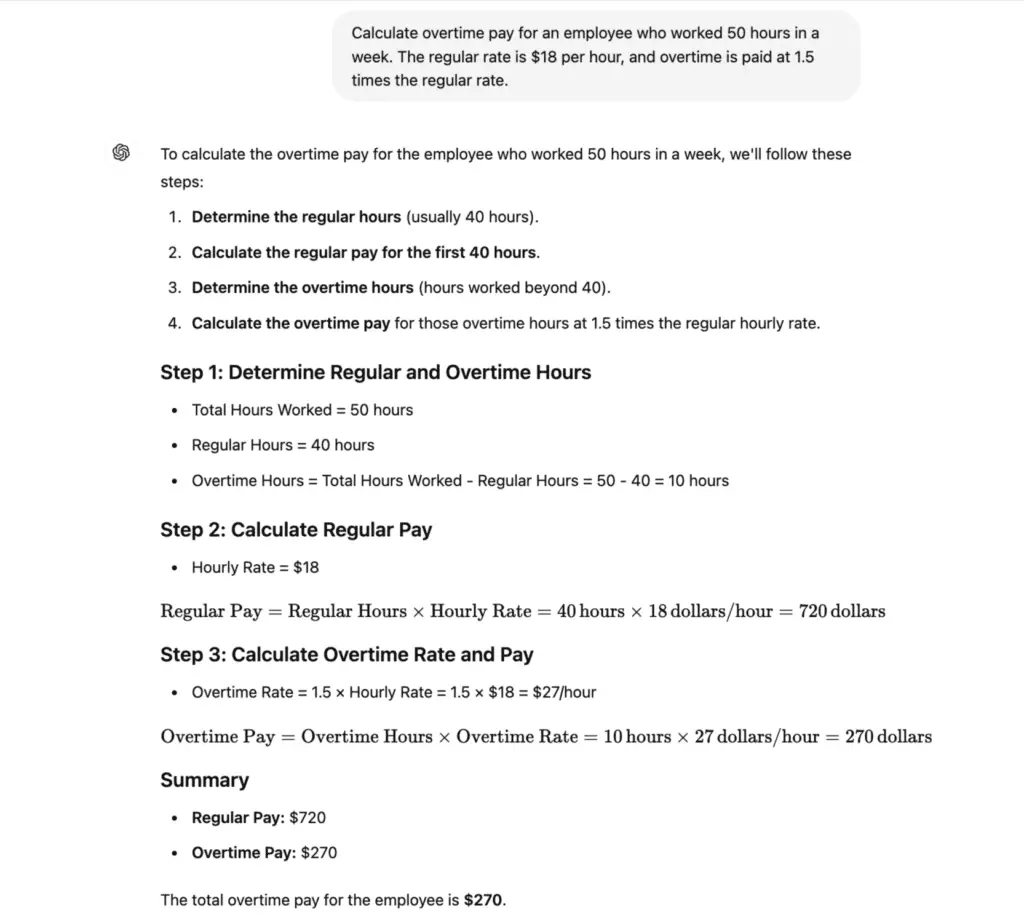

3. Overtime Pay Calculation

Overtime pay must be calculated accurately based on the number of extra hours worked and the overtime rate. Use this prompt to automate overtime calculations:

Prompt: “Calculate overtime pay for an employee who worked 50 hours in a week. The regular rate is $18 per hour, and overtime is paid at 1.5 times the regular rate.”

This prompt will calculate the employee’s overtime pay, ensuring that labor laws are followed regarding overtime compensation.

4. Deductions and Benefits Calculation

In addition to taxes, payroll managers must account for various deductions, such as health insurance premiums, retirement contributions, and voluntary benefits. Here’s a prompt to help with deductions:

Prompt: “Calculate total deductions for an employee with $500 in health insurance premiums, $200 in 401(k) contributions, and $50 in voluntary benefits from a biweekly paycheck of $2,500.”

This prompt will automatically calculate the total deductions, giving you the net pay for the employee after all necessary withholdings.

ChatGPT Prompts for Payroll Compliance and Reporting

Compliance is one of the most critical aspects of payroll management. Payroll managers must ensure they follow tax laws and meet reporting requirements. ChatGPT can assist by automating compliance checks and report generation. Below are some useful prompts for payroll compliance and reporting:

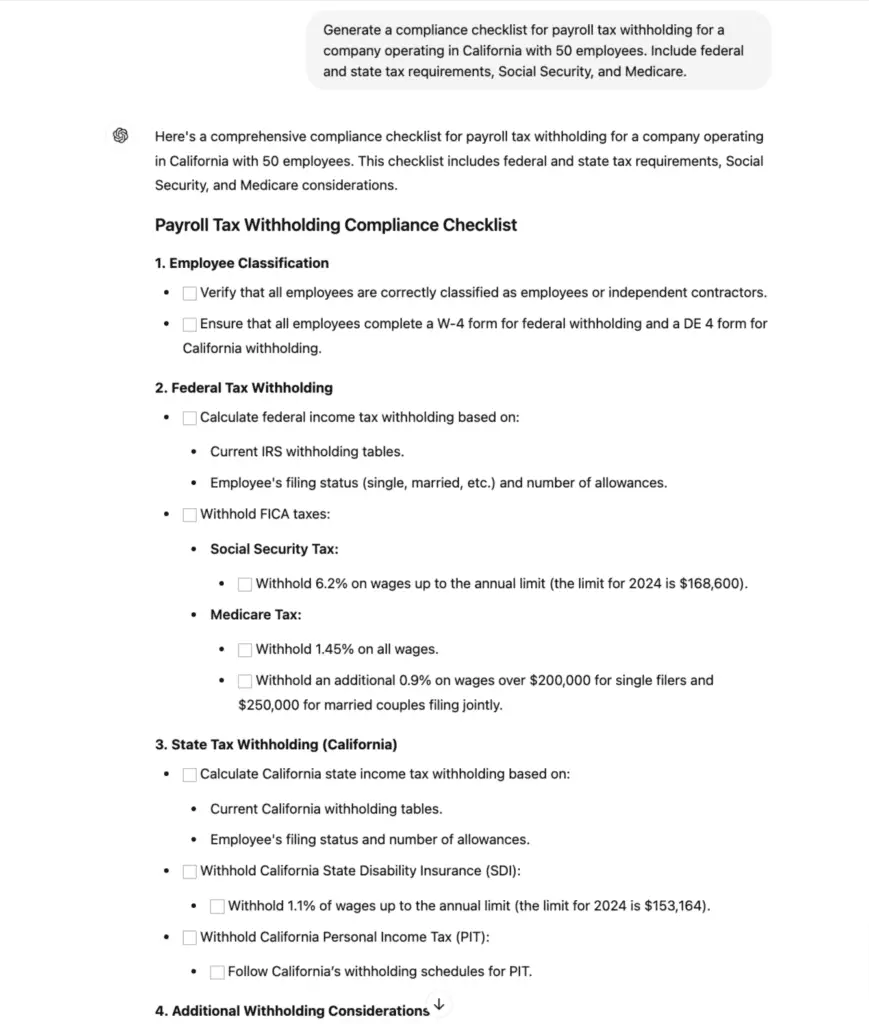

1. Payroll Tax Compliance

Ensuring compliance with local, state, and federal tax regulations is essential to avoid penalties. ChatGPT can help you check compliance for payroll taxes:

Prompt: “Generate a compliance checklist for payroll tax withholding for a company operating in California with 50 employees. Include federal and state tax requirements, Social Security, and Medicare.”

ChatGPT will generate a checklist ensuring that your payroll processes comply with tax laws in your jurisdiction.

2. Payroll Summary Report

Payroll managers often need to generate summary reports for each payroll cycle. These reports provide a snapshot of total gross wages, taxes, deductions, and net pay. Use the following prompt:

Prompt: “Generate a payroll summary report for a small business with 15 employees, including total gross wages, tax withholdings, deductions, and net pay for the pay period.”

This prompt will allow ChatGPT to quickly generate the summary report, which can then be reviewed and shared with company stakeholders.

3. Year-End Payroll Report

At the end of the fiscal year, payroll managers must provide detailed reports to ensure compliance with financial regulations and tax filings. Use this prompt for generating year-end payroll reports:

Prompt: “Generate a year-end payroll report for a company with 50 employees, including total wages paid, taxes withheld, deductions, and net pay for the entire year.”

With this prompt, ChatGPT will provide a comprehensive year-end payroll report that you can use for tax filings and financial audits.

4. Compliance with Wage and Hour Laws

Ensuring compliance with wage and hour laws, especially overtime laws, is crucial to avoid lawsuits and penalties. Here’s a prompt to check wage and hour compliance:

Prompt: “Generate a compliance checklist for wage and hour laws for a company in New York, ensuring compliance with federal overtime laws and New York state wage regulations.”

ChatGPT will provide a detailed checklist that helps payroll managers ensure their processes comply with both state and federal wage laws.

ChatGPT Prompts for Employee Payroll Queries

Payroll managers are often responsible for answering employee queries about their pay, deductions, taxes, and benefits. ChatGPT can help generate quick and accurate responses to common payroll-related questions, saving time and improving employee satisfaction.

1. Paycheck Explanation

Employees may need clarification on how their paycheck is calculated, especially if they notice changes in their net pay. Here’s a prompt for explaining paycheck details:

Prompt: “Explain the breakdown of an employee’s paycheck with gross pay of $4,000, $500 in federal tax withholdings, $250 in state tax withholdings, $300 in retirement contributions, and $100 in health insurance premiums.”

ChatGPT will generate a clear explanation of the paycheck, breaking down each component so the employee understands how their net pay is calculated.

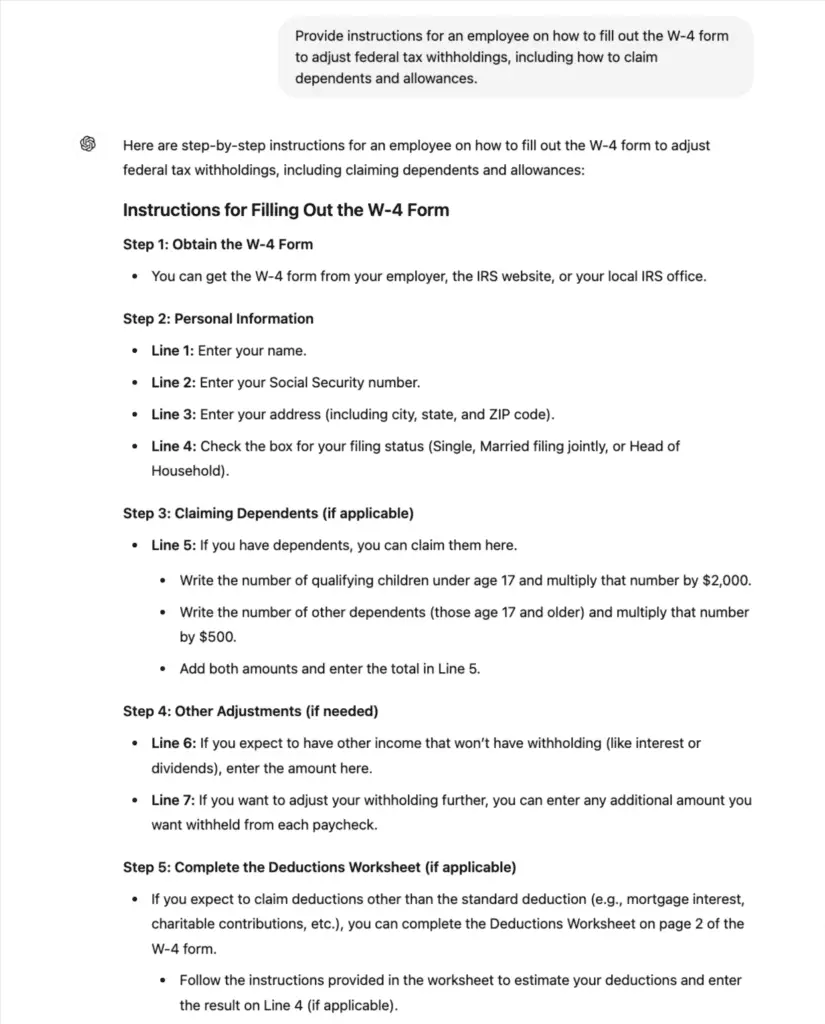

2. W-4 Form Assistance

Employees may need help filling out their W-4 forms to adjust their tax withholdings. Use this prompt to explain the process:

Prompt: “Provide instructions for an employee on how to fill out the W-4 form to adjust federal tax withholdings, including how to claim dependents and allowances.”

ChatGPT will generate step-by-step instructions for employees, ensuring they can fill out their W-4 forms correctly.

3. Payroll Deduction Explanation

Employees often have questions about various deductions taken from their paychecks, such as taxes, benefits, and retirement contributions. Here’s a prompt to explain deductions:

Prompt: “Explain to an employee why they see deductions for health insurance, retirement contributions, and federal income tax on their paycheck of $2,500.”

ChatGPT will generate an explanation of each deduction, helping employees understand the reason behind these withholdings.

4. Payroll Change Request Response

Employees might request changes to their payroll information, such as updating their tax withholdings or direct deposit details. Here’s a prompt to handle these requests:

Prompt: “Generate a response to an employee requesting a change in their payroll direct deposit account and update of their W-4 form for tax withholdings.”

This prompt will help payroll managers quickly draft a professional response to employee requests for payroll changes.

ChatGPT Prompts for Payroll Data Analysis

Payroll managers must often analyze payroll data to make decisions regarding budgeting, forecasting, and employee compensation. ChatGPT can help generate reports and insights based on payroll data.

1. Payroll Cost Analysis

Analyzing payroll costs is essential for budgeting and financial planning. Use this prompt to generate an analysis:

Prompt: “Generate a payroll cost analysis for a company with 100 employees, including gross wages, payroll taxes, and benefits expenses for the last quarter.”

This prompt will allow ChatGPT to provide a detailed cost analysis, helping payroll managers make informed decisions about staffing and compensation.

2. Compensation Benchmarking

Compensation benchmarking helps ensure that your company’s salaries are competitive with industry standards. Use this prompt for benchmarking analysis:

Prompt: “Generate a compensation benchmarking report for a software development company, comparing salaries for developers, testers, and project managers against industry averages.”

This prompt will allow ChatGPT to generate a benchmarking report, helping payroll managers adjust compensation packages to remain competitive in the market.

3. Payroll Forecasting

Payroll forecasting helps companies plan for future staffing needs and budget allocation. Here’s a prompt to forecast payroll expenses:

Prompt: “Forecast payroll expenses for the next six months for a company with 50 employees, considering an average salary increase of 5%, including payroll taxes and benefits costs.”

This prompt will generate a payroll forecast, helping payroll managers allocate resources effectively for future pay periods.

4. Overtime Cost Analysis

Overtime costs can add up quickly, so payroll managers need to analyze them regularly. Use this prompt to generate an overtime cost analysis:

Prompt: “Generate an overtime cost analysis for the last three months for a company with 25 employees, including total overtime hours worked and the impact on payroll expenses.”

This analysis will help payroll managers monitor overtime usage and its effect on payroll costs.

Final Thoughts

Payroll management is a critical function in any organization, and using AI tools like ChatGPT can help payroll managers improve efficiency, reduce errors, and ensure compliance. By using ChatGPT prompts, payroll managers can automate tasks such as payroll calculations, tax compliance, employee queries, and data analysis, saving time and resources in the process.

The prompts provided in this guide can serve as a starting point for automating various payroll-related tasks, from calculating gross pay to analyzing compensation data. By leveraging ChatGPT, payroll managers can focus on strategic decision-making and ensuring the smooth operation of payroll processes within their organization.

Frequently Asked Questions (FAQs)

How can ChatGPT help with payroll tax compliance?

ChatGPT can assist payroll managers by generating compliance checklists, calculating tax withholdings, and ensuring that payroll processes meet federal and state tax regulations.

Is ChatGPT useful for payroll cost analysis?

Yes, ChatGPT can help analyze payroll data, including gross wages, payroll taxes, benefits, and overtime costs, providing insights for budgeting and financial planning.

Can ChatGPT handle employee payroll queries?

ChatGPT can generate clear responses to common payroll queries, such as explaining paycheck breakdowns, deductions, and how to fill out tax forms like the W-4.

How does ChatGPT help with payroll processing?

ChatGPT can assist with payroll calculations, including gross pay, overtime, and deductions, ensuring accuracy and saving payroll managers significant time.

Can ChatGPT generate payroll reports?

Yes, ChatGPT can generate various payroll reports, including payroll summaries, year-end reports, and tax compliance reports, helping payroll managers maintain detailed records.

How can I integrate ChatGPT into my payroll workflow?

You can integrate ChatGPT into your payroll workflow by using it for tasks like report generation, tax compliance checks, and answering employee queries. Start with predefined prompts and customize them as needed for your specific processes.